Vrede wrote:Whether we should be encouraging saving and investment while discouraging consumer spending right now is a different discussion and is beyond my economics prowess.

But, you have still not explained why it's double taxation if it's done to corporate investment income but it's not double taxation if it's done to corporate wages income. Nor have you explained why it's okay to tax the income of a manual laborer or cancer doc at a higher rate than the investment income of a non-producer like Mitten.

Corporate profits are the residual after expenses. Labor is an expense, so it is deducted prior to corporate taxation.

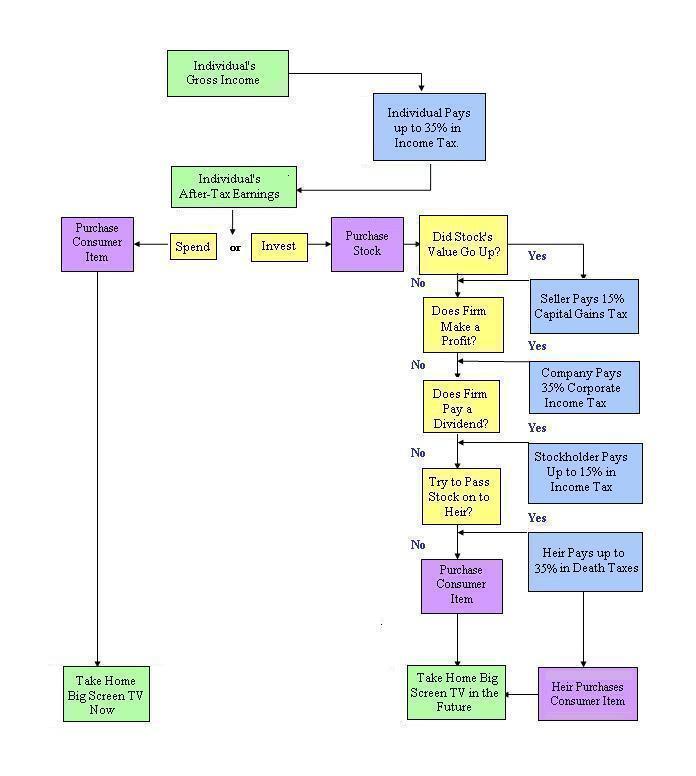

Capital gains tax, in addition to double taxation is not adjusted for inflation, so any appreciation of assets is taxed at the nominal instead of the real value. This means investors must pay tax not only on the real return but also on the inflation created by the Federal Reserve.

Finally, a capital gains tax, like nearly all of the federal tax code, is a tax on future consumption. Future personal consumption, in the form of savings, is taxed, while present consumption is not. By favoring present over future consumption, savings are discouraged, which decreases future available capital and lowers long term growth.

Not only has a low capital gains tax rate worked to encourage savings and increase economic growth, a low capital gains rate has historically raised more in tax revenue

(at least those are the arguments eCONomists give.)